You don't say!

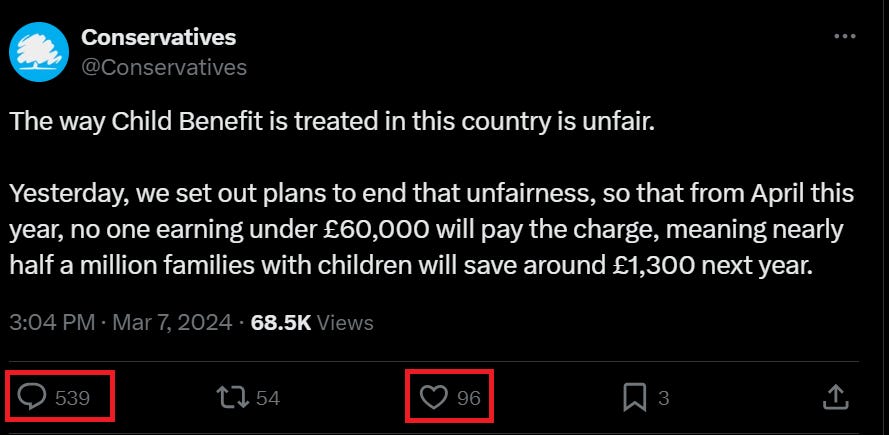

The Tories are claiming that they're fixing Britain's unfair Child Benefit system, but they're the ones who made it so unfair, and their so-called "fix" is an insufficient bodge job

When the Tories admit that Britain’s Child Benefit system is "unfair" it’s one of those rare occasions that it’s actually possible to agree with what they’re saying. But don’t worry, they quickly followed it up with a load of deceptive rubbish.

The first thing to note is that this unfairness was entirely created by the Tory party themselves.

In 2010 David Cameron and George Osborne decided to fundamentally change Child Benefit by stopping it from being a universal thing that everyone with kids is entitled to, and they did it it a quite obviously unfair way.

Instead of calculating Child Benefit entitlement based on household income, they decided to calculate it on the earnings of the highest earner in the household.

This meant that a couple both earning £50,000 for a six figure combined household income would still receive all of it, but a single parent or a household with a single earner would have it taken away again through the tax system if the salary rose above £50k.

Some people might try to argue that it’s wasn’t all that important because if they’re earning over £50k a year they’re doing alright anyway, and that there are much bigger injustices to fight against. However this is wrong-headed for a couple of reasons.

If the government introduces regulations that are transparently unfair for relatively rich people, you can be absolutely sure that they’re not going to care about fairness when they’re legislating on issues that impact the lives of the poor and ordinary either.

If they won’t even act fairly towards their own target demographics, what hope is there for the rest of us?

Then there’s the destruction of the universality principle itself. Once the Tories established the new principle that Child Benefit can be taken away for one reason, it was obvious that they’d bring in different forms of conditionality to take it away from others too.

And that’s exactly what happened in 2015 when Cameron and Osborne announced the depraved poverty-spreading "two child" policy to deny Child Benefit and Child Tax Credits to parents who have more than two children.

The birth rate necessary for a society to maintain population stability is 2.05 children per couple, and given the increasing numbers of people who choose not to have children, it’s obvious that some people need to have three or more kids in order to maintain population stability (the other option being mass immigration - which the Tories constantly whine and rabble-rouse about).

Financially punishing parents for doing what’s necessary to maintain population stability is obscene, and condemning hundreds of thousands of kids to growing up in poverty because they happen to have more than one sibling is even worse.

The most depraved thing of all though is the "rape clause" which allows parents to claim Child Benefit on a third child only if they sign a form with a declaration saying they were raped or otherwise coerced into sex, and naming the child as a rape baby.

So the Tories are right. The Child Benefit system is profoundly and obscenely unfair.

However they’re the ones who made it so unfair.

What makes it so much more infuriating is the Tory lie that they’ve "set out plans to end the unfairness" when they’re just tinkering with the unfair conditionality rules they introduced to favour only households where the highest earner takes home between £50k - £60k.

They’re not making Child Benefit a universal benefit again.

They’re not getting rid of the eugenicist two-child policy or the moral obscenity of the "rape clause".

They’re not even changing the conditionality rules to take account of overall household income, rather unfairly judging eligibility based on highest earner income.

They Tories broke it, and now they’re boasting about fixing it when they’re actually just tinkering with the unfair rules to favour a narrow band of relatively high earners.

You just can’t trust a word they say.

Even on the rare occasions they say something that’s actually true, it’s still shrouded in deception.

If i remember rightly, the reason it was reduced if one earner was a higher tax payer was for purely practical reasons. It was much, much easier to do it this way then a combined household income. At the time HMRC did not have the ability because there IT systems were shocking. HMRC have done an amazing job over the last decade. All taxes are unfair, and full of cliff edges, mainly for initially practical and legitimate reasons.

Seeking volunteer executive founders to bring new From Infants to Over 50s political party into swift registration to run in this year's general election. www.over50sparty.org.uk

With policy to end 2 child benefit cap and end tax and constraint on child benefit by income.